The Government announced a budget deficit of $36.9 billion for 2022-23, widening to $44.0 billion in 2023-24, $51 billion in 2024-25 and $50 billion in 2025-26.

While the 2022-23 deficit is less than half the $78 billion forecast in the May budget, deficits are still forecast to spiral over the next three years as interest rates rise and economic growth slows.

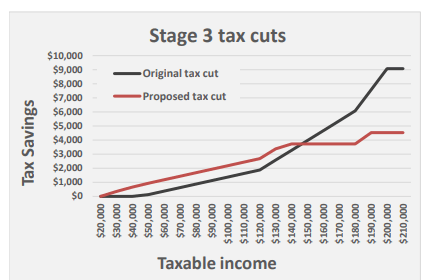

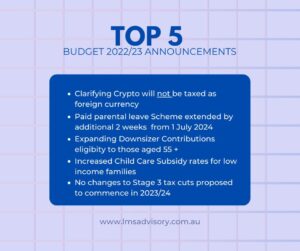

There is nothing in this Budget that would create a UK style crisis. The stage 3 tax cuts legislated to commence on 1 July 2024 are not mentioned, and most funding initiatives appear to be a reallocation of previous Government initiatives. And, the commodity driven $54.4 billion improvement in tax receipts has largely been banked, not spent. With seven months before the 2023-24 Budget released in May 2023, this Budget is a shuffling of the deck not a new set of cards. And to continue the pun, we need to play the hand we have been dealt, buffeted by externalities – war, floods, and global uncertainty.

Cost of living pressures will continue. While some initiatives such as the increase to childcare subsidies will help, the Budget flags some fairly bracing economic expectations:

- Inflation expected to peak at 7.75% in the December quarter and will persist at higher rates for longer than expected before easing to 3.5% by June 2024.

- Real GDP is forecast to grow to 3.25% in 2022-23 then retract to 1.5% in 2023-24.

- Electricity prices are expected to increase nationally by an average of 20% in late 2022, with retail electricity prices

expected to rise by a further 30% in 2023- 24.

The ATO gets an extra $80m to extend its personal income tax compliance program, with $674m anticipated in increased receipts and over $80m in increased payments as a result. Tax deductions will be looked at closely. As expected, multi-nationals are a target. New measures will limit opportunities to shift taxable profits offshore.

The ATO’s Tax Avoidance Taskforce is expected to deliver a whopping $2.8bn in additional tax receipts and $1.1bn in payments over the 4 year period.

If we can assist you to take advantage of any of the Budget measures, or to risk protect your position, please let us know

For a full budget summary, please download our Budget 2023 Client update

Contact us if you’d like more information!