What is Single Touch Payroll Phase 2?

In a nutshell, Single Touch Payroll Phase 2 delivers expanded reporting categories reported by your payroll software provider when you prepare pay runs.

But Wait, what is Single Touch Payroll?

Single Touch Payroll (STP), is an Australian Government initiative to reduce employers’ reporting burdens to government agencies. With STP, you report employees’ payroll information to us each time you pay them through STP-enabled software.

Payroll information includes:

- salaries and wages

- pay as you go (PAYG) withholding

- superannuation.

STP started on 1 July 2018 for employers with 20 or more employees and 1 July 2019 for employers with 19 or fewer employees and is a mandatory obligation.

Benefits of STP Phase 2

- Single Touch Payroll Phase 2 will provide assistance with employers automatically sharing information between government agencies, most notably Services Australia – Centrelink with every pay run.

- It will reduce an Employers need for manual paperwork such as Employment Separation Certificates and Child Support reporting – Garnishee & Deductions.

- It will also help Employees with Government assistance, and a more seamless ITR process

When does Phase 2 start?

The mandatory start date for STP Phase Reporting is 1 January 2022.

Voluntary reporting can begin now if the client’s payroll software allows.

It is important to note that employers will have until 1 March 2022 to commence reporting, with no need to apply to the ATO for a deferral. Ideally though, our practice will begin all reporting by 1 January 2022 where the software is ready.

Some payroll software providers require more time to make the necessary changes and have applied for deferrals for this start date. If they have applied, they will inform customers of the deferral date. The Software User DOES NOT have to apply for an individual deferral if this is the case.

There will not be any penalties for genuine mistakes for the first year of Phase 2 reporting – to 31 December 2022.

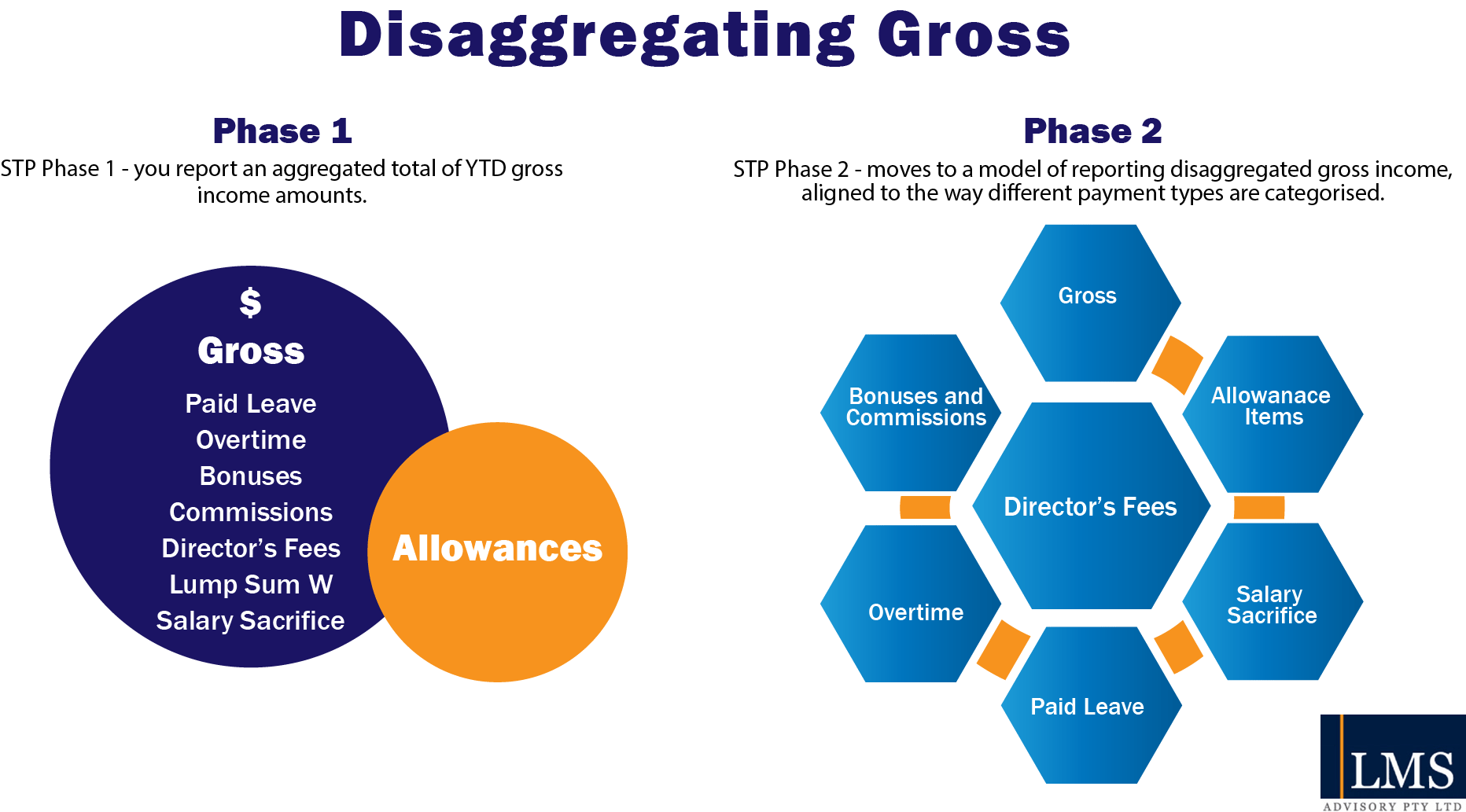

So what is changing between Phase 1 and 2?

The Key changes include:

1. The ATO will allow negative YTD amounts to be submitted in the STP report when making corrections.

If you prepare payruns now and report STP, you know how beneficial this will be!

2. Payroll Software transitions

Phase 2 will prevent duplicate income statements if a client changes payroll software mid year.

Businesses transitioning from one software to another will be able to enter the previous BMS ID in the new system, and the ATO will link the information so that only one income statement is reported for each Employee.

3. Termination

We will now have to add a cessation reason upon employment termination. We will have to enter the termination date, along with the reason for termination (resignation etc).

This removes the the need for an Employment separation certificate to be issued to an employee.

4. Child Support

Currently, employers have to submit a deduction report when deducting child support from an employees pay.

Through Phase 2, this will be reported through STP pay events, removing the need to report separately.

This will initially be voluntary. Not all software will incorporate this functionality.

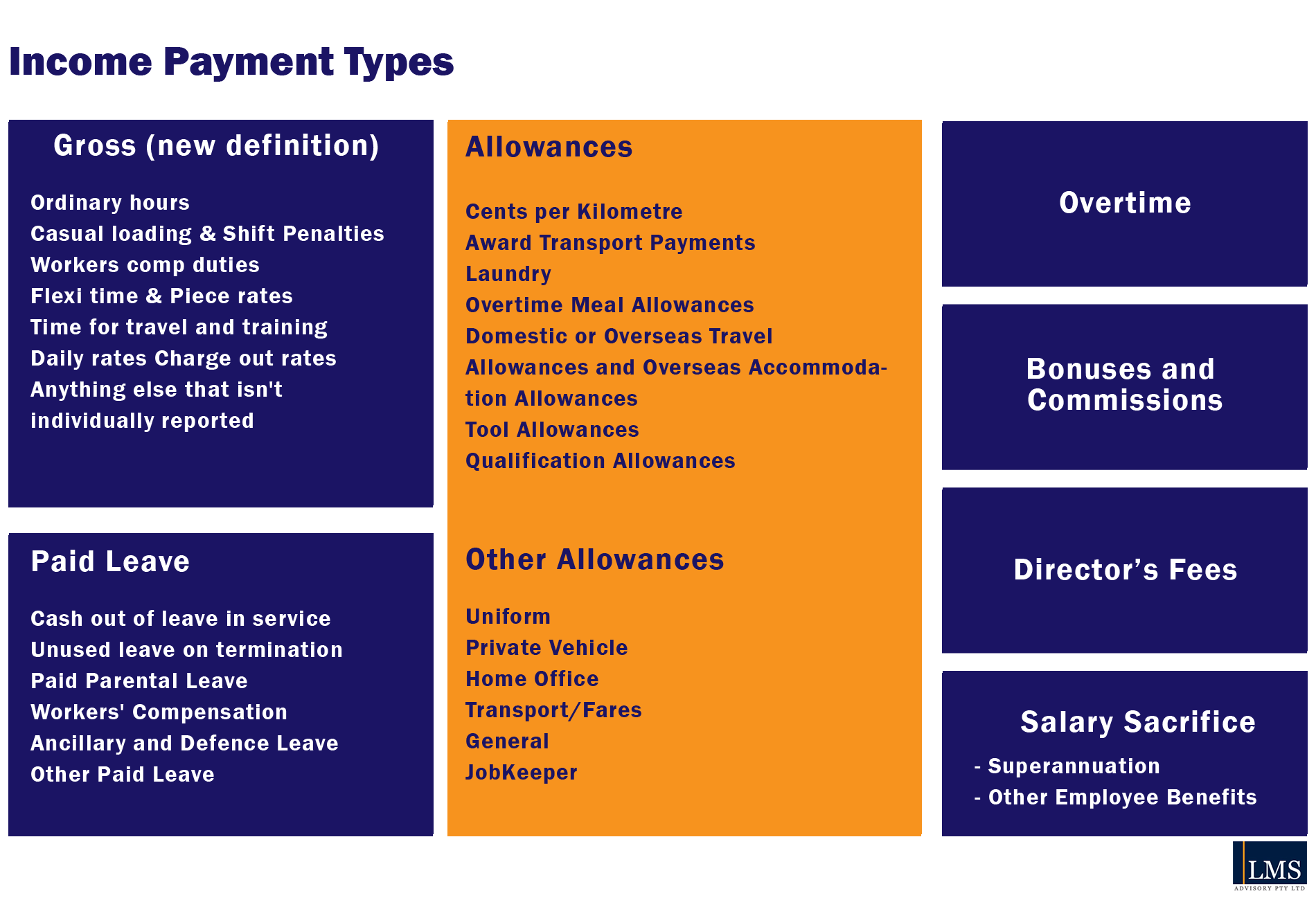

4. Introduction of Income Types and Country Codes – Income Stream collection

Employers will need to classify the payments made to an employee using ‘income stream collection’ when they submit STP to the ATO.

This includes the following income types and may also include a country code for some income types (eg, when making a payment to an Australian resident working overseas):

[accordion title=”Income Types and Country Codes” open1st=”1″ openAll=”0″ style=””]

[accordion_item title=”Salary and Wages (SAW) “]Assessable income paid to employees for work performed in Australia, other than that included as other Income Types [/accordion_item]

[accordion_item title=”Closely Held Payees (CHP) “]A payee directly related to this small employer from which they receive payments family members of a family business; directors or shareholders of a company; beneficiaries of trust [/accordion_item]

[accordion_item title=”Inbound Assignees to Australia (IAA)”]Some multinational employers exchange. or transfer, employees between affiliated entities in different tax tunsdictiont This is done for business and commercial purposes

[/accordion_item]

[accordion_item title=”Working Holiday Maker (WHIN) “]Income only for limited visa subclasses – 417 (Working Holiday) and 462 (Work and Holiday) [/accordion_item]

[accordion_item title=”Seasonal Worker Program (SWP)”]Regional programmes for government.approved employers Seasonal Worker Programme (SWP) -administered by the Department of Employment. Sles. Small and Family Business [/accordion_item]

[accordion_item title=”Foreign Employment Income (FEI)”]Assessable income paid to payees who are Australian six residents, that is sub;ect to tax in another country. for work performed in that country. if the qualification period is met[/accordion_item]

[accordion_item title=”Joint Petroleum Development (JPDA) “]Payments to individuals for work or services performed in the JPDA where the payment is covered by Subdivision 12-B of schedule 1 to the TAA and the employee provided • valid TFN to the payer.

[/accordion_item]

[accordion_item title=”Voluntary Agreement (VOL) “]A written agreement between a payer and • contractor Payee to bring work payments into the PAYGW system. The payer does not have to withhold amounts for payments they make to contractors.

[/accordion_item]

[accordion_item title=”Labour Hire (LAB) “]Payments by a business that arranges for persons to perform work or services, or performances, directly for clients of the entity.[/accordion_item]

[accordion_item title=”Other Specified Payments (OSP)”]Specified payments by regulation 27 of the Taxation Administration Regulations 2017 [/accordion_item]

[/accordion]

5. Salary Sacrifice is no longer deducted from Gross payments for reporting.

This means that BAS W1 will no longer be reported as the post-sacrificed income (Gross – Salary Sacrifice)

We will now be reporting the pre-Sacrificed income at W1:

Reporting Salary Sacrifice Income Example

Anne earns $60,000 per annum and sacrifices $3,000 into superannuation. In STP Phase I you reported the post-sacrificed income of $57,000 i.e. ($60,000 less $3,000)

In STP Phase 2 you are required to report the pre-sacrificed income as well as the amount of salary sacrifice.

- gross: $60,000

- salary sacrifice type S (superannuation): $3,000

6. Tax Treatment Code – STP Phase 2 report will include a six-character tax treatment code for each employee.

- The tax treatment code is an abbreviated way of telling the ATO about factors that can influence the amount that is withheld from employees.

- Reporting this information through STP means you no longer need to send TFN declaration to ATO

- Digital payroll solution (QuickBooks) will automate the reporting of these codes based on the information you enter.

- It is important for you to understand what the codes mean as it will form part of your STP report.

Tax Treatment Code Example

Harry has given a TFN declaration to his employer. He has claimed the tax-free threshold and notified his employer that he has a study and training support loan. He has not asked his employer to vary the amount withheld from his pay for the Medicare levy. When Harry’s employer reports the salary and wages that is paid to Harry through STP, they includes a tax treatment code.

The tax treatment code reported is RTS300C, which represents:

R = regular employee, as Harry’s employer knows he is not receiving any other income type.

T = tax-free threshold, as Harry has claimed the tax-free threshold in his TFN declaration.

S = study and training support loan (STSL), as Harry has notified his employer in his TFN declaration that he has a STSL.

X = not applicable, as Harry has not asked his employer to vary the amount withheld due to Medicare levy surcharge.

X = not applicable, as Harry has not asked his employer to vary the amount withheld due to a Medicare levy exemption.

X = not applicable, as Harry has not asked his employer to vary the amount withheld due to a Medicare levy reduction.

If you have any questions in relation to your Payroll or Single Touch Payroll Processes, please contact us

If you want someone else to do your Payroll for you, the team at Keep My Books Online can help take the pressure off you so you can focus on what matters.