Legislative Changes that affect JobKeeper 2.0 – Updated 24 August 2020

We have collated various resources from our professional partners and networks. We will work with our clients to test eligiblity ASAP.

Importantly, employers and entities with eligible business participants are able to enrol for the JKP for the extension period even where they have not previously enrolled, subject to meeting all the new and existing

eligibility criteria (e.g., a business was carried on in Australia on 1 March 2020).

The decline in turnover test

For businesses already enrolled in JobKeeper, to receive payments from 28 September 2020, you need to meet an extended decline in turnover test based on actual GST turnover.

Businesses that are enrolling for the first time, need to meet the basic eligibility test and the decline in turnover test/s for the relevant period.

30 March to 27 September 2020

28 September to 3 January 2021

4 January 2021 to 28 March 2021 Decline in turnover test Projected GST turnover for a relevant month or quarter is expected to fall by at least 30% (15% for ACNC-registered charities, 50% for large businesses) compared to the same period in 2019.* Actual GST turnover in the September 2020 quarter (July, August & September) fell by at least 30% (15% for ACNC-registered charities, 50% for large businesses) compared to the same period in 2019.* Actual GST turnover in the December 2020 quarter (October, November & December) fell by at least 30% (15% for ACNC-registered charities, 50% for large businesses) compared to the same period in 2019.*

* Alternative tests may apply

Most businesses will generally use their Business Activity Statement (BAS) reporting to assess eligibility. However, as the BAS deadlines are generally not until the month after the end of the quarter, eligibility for JobKeeper will need to be assessed in advance of the BAS reporting deadlines to meet the wage condition for eligible employees.The ATO has the power to extend the time an entity has to pay employees in order to meet the wage condition. For the JobKeeper fortnights starting 28 September 2020 and 12 October 2020 the ATO is allowing employers until 31 October 2020 to meet the wage condition for all employees included in the JobKeeper scheme.

Calculating GST turnover

Calculating GST turnover for tranches 2 and 3 of JobKeeper is different to the original JobKeeper requirements as entities will only be using current GST turnover figures (not projected GST turnover).

When applying the new turnover reduction tests for the September 2020 quarter and December 2020 quarter, entities that are registered for GST must use the same method that is used for GST reporting purposes. That is, if the entity is registered for GST on a cash basis then a cash basis needs to be used to calculate current GST turnover for the purpose of these new tests. Entities that are not registered for GST can choose whether to calculate GST turnover using a cash or accruals basis, but must use a consistent method.

Current GST turnover includes proceeds from the sale of capital assets, unless the sale is input taxed. Current GST turnover includes taxable and GST-free supplies, but should exclude input taxed supplies such as residential rental income and financial supplies like dividends, interest etc. JobKeeper and ATO cash flow boost payments should be excluded from the calculation along with other payments that don’t represent consideration for a supply made by the entity such as certain State based grants.

You will need to show that your actual GST turnover has declined in the September 2020 quarter relative to a comparable period (generally the corresponding quarter in 2019). See the actual decline in turnover test.

You also need to have satisfied the original decline in turnover test. However, if you:

Were entitled to receive JobKeeper for fortnights before 28 September, you have already satisfied the original decline in turnover test

are enrolling in JobKeeper for the first time from 28 September 2020, if you satisfy the actual decline in turnover test, you will also satisfy the original decline in turnover test (except for certain universities). You can enrol on that basis.

Here are some resources from our Professional Partners:

- JobKeeper from 280920 – LMS ADVISORY KS GUIDE

- NTAA – Extension of JKPs

- JobKeeper 2.1_R.JacobsonNTAA – Extension of JKPsJobKeeper 2.1_R.Jacobson0

- https://www.ato.gov.au/General/JobKeeper-Payment/JobKeeper-key-dates/

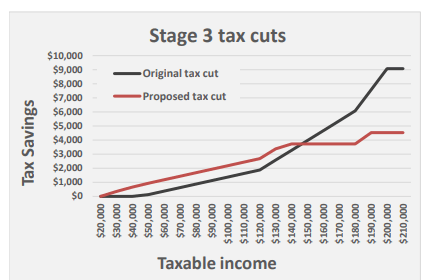

This infographic Below from the Tax Institute provides a visual summary.

The extension of the JKP by six months to 28 March 2021 will see the scheme tapered with respect to

both the December 2020 and March 2021 quarters for all eligible employees and business participants to

provide appropriately targeted assistance. In addition, a two-tiered payment system will apply based on

hours of work or active engagement.

To qualify for the JKP after 27 September 2020 (i.e., for JobKeeper 2.0) businesses must satisfy two

separate decline in turnover tests, being:

• the original projected GST decline in turnover test – adjusted under the Amending Rules to include a

comparison of the projected GST turnover of any of the calendar months from March 2020 to December

2020 (or any of the June 2020, September 2020 or December 2020 quarters) against the actual GST

turnover of the relevant 2019 comparison period; and

• the new actual GST decline in turnover test – contact us for more information

Legislative Changes that affect JobKeeper 1.0 – Updated 28 August 2020

Legislation introduced for extended JobKeeper payments

Legislative amendments to allow the government to make payments for the JobKeeper Payments scheme up to Sunday 28 March 2021 have been introduced into Parliament. The extension of scheme beyond Sunday 27 September 2020 was announced on Tuesday 21 July 2020.Extended JobKeeper prescribed period

The Coronavirus Economic Response Package (Jobkeeper Payments) Amendment Bill 2020 amends the Coronavirus Economic Response Package (Payments and Benefits) Act 2020 to revise the existing “prescribed period” which otherwise ends on Thursday 31 December 2020, to facilitate the extension of the scheme to Sunday 28 March 2021.Eligible financial service providers to sign decline in turnover test certificates for Fair Work purposes

The Bill also makes amendments to the Fair Work Act 2009 in relation to the extended JobKeeper Payments scheme. This includes the proposed sections 789GC, 789GCB and 789GCD of the Fair Work Act which will require certain businesses to obtain a certificate from an eligible financial service provider, including registered tax agents and BAS agents, stating that the entity has satisfied the 10% decline in turnover test per JobKeeper rules and legislative instruments. This will enable legacy JobKeeper employers to be able to give JobKeeper enabling stand down directions and JobKeeper enabling directions in relation to duties and location of work and can make agreements about days and times of work.

JobKeeper August declaration – what is different

The August JobKeeper monthly business declaration is due by Friday 14 September. The August declaration is different with three fortnights to claim:

- Fortnight 9 – commencing 20 July

- Fortnight 10 – commencing 3 August

- Fortnight 11 – commencing 17 August 2020.

Remember to include employees that are newly eligible and employed at Wednesday 1 July 2020. You can do this as part of the monthly declaration, however newly eligible employees as at 1 July can only be included from fortnight 10. For fortnights 10 and 11, you have until Monday 31 August to meet the wage condition for all new eligible employees included in the JobKeeper scheme, under the 1 July eligibility test.

LMS clients were provided with an update on JobKeeper 2.0 on the 4th August 2020. Please note New legislation and announcements by Treasury were made on the 12th August 2020 which affect the current JobKeeper scheme as it applies to your business.

The most important factor to be aware of relates to changes to the employment reference date. This is the key date that we tested employee eligibility at the commencement of the scheme. Click on any of the hyperlinks below for more detailed information.

The date has been moved from 1 March 2020 to 1 July 2020. This means more employees on your payroll may become eligible for Jobkeeper. The effective date of this change relates to pay runs commencing 3rd August 2020 (Jobkeeper Fortnight 10). You will have until 31 August 2020 to “Top Up” any new employees with a payment shortfall.

Businesses will need to reassess eligibility at 1 July to see if

- Any new employees satisfy the Employee Eligibility criteria

- Ensure they are provided with the latest Employee nomination forms, and

- the minimum wage condition is satisfied before 31 August 2020

New employees who could meet the criteria include those who satisfy the 1 July 2020 Test:

- Employee’s working on a full time or part time basis who commenced employment between 1 March 2020 and 1 July 2020.

- Long term casuals who were not eligible as at 1 March 2020 because they were employed for less than 12 months, but reach 12 months service by 1 July 2020

- Anybody who turned 18 years old after 1 March 2020 and before 1 July 2020 who was previously excluded due to age may now be eligible (other criteria applies)

Current Existing employees under the Jobkeeper payment regime do not need to be retested, they will continue to be eligible. Your role as an employer will be to reassess the remainder of your workforce who were previously excluded.

Please contact us urgently if you require assistance in reassessing eligibility.

Government Stimulus JobKeeper 2.0 – Updated 24 July 2020

Jobkeeper 2.0 Fact Sheets

Our professional partners at the Tax Institute (www.taxinstitute.com.au) have published a 4 Page Infographic which you can print or save to desktop

JobKeeper 2.0 – Tax Institute Printable Factsheet

Our professional partners at Employment Innovations (www.employmenthero.com.au) have published an Excellent Jobkeeper 2.0 Fact Sheet

JobKeeper-2.0-Extension-Fact-Sheet-Employment-Hero

JobKeeper redesigned (Source Tax Institute Australia) published 24.7.2020

The Government announced on 21 July 2020 that a modified JobKeeper program will continue for another six months beyond its legislated end date of 27 September 2020 until 28 March 2021. This follows a three-month review of JobKeeper which concluded that the case for extending JobKeeper beyond September is strong. The review suggested that:

- The Government could introduce a two-tiered payment system under which part-time employees receive a lower payment; and

- A new decline in turnover test using actual rather than projected turnover should apply to ensure JobKeeper remains well targeted.

No changes will be made to the existing JobKeeper arrangements until 28 September 2020.

Reduced rates

A two-tiered system will apply so that employees who worked for 20 hours or more in the four-week period before 1 March 2020 will be entitled to a higher JobKeeper amount (the ‘full rate’) than those employees who worked less than 20 hours on average in February 2020 (the ‘partial rate’). The rate will also taper the assistance to encourage businesses to meet a greater share of their own wages as economic conditions are expected to improve.

Under JobKeeper 2.0, the fortnightly rate will be reduced from $1,500 in two stages:

- From 28 September 2020 to 3 January 2021, the full fortnightly rate will be $1,200 and the partial rate will be $750;

- From 4 January 2021 to 28 March 2021, the full fortnightly rate will be $1,000 and the partial rate will be $650.

Businesses and not-for-profits will need to nominate which payment rate they are claiming for each of their eligible employees or eligible business participants. The Commissioner will have a discretion to set out alternative tests where the individual’s working hours were unusual, for example where they were on leave, unemployed for all or part of February or were volunteering to fight the bushfires.

The full rate of $1,200 (from 28 September 2020 to 3 January 2021) or $1,000 (from 4 January 2021 to 28 March 2021) will be available for an eligible business participant only if they are ‘actively engaged’ in the business for 20 hours or more per week on average in February 2020. The partial rate of $750 (from 28 September 2020 to 3 January 2021) or $650 (from 4 January 2021 to 28 March 2021) will be available for an eligible business participant where they are ‘actively engaged’ in the business for less than 20 hours per week on average in February 2020. Under the current rules, an individual is eligible to be an eligible business participant if they are ‘actively engaged’ in the business. This term is not defined in the law and has never had to be accurately measured. Guidance on this will be necessary so businesses can correctly determine which JobKeeper rate applies to an eligible business participant.

To date, each month in the program has contained only two JobKeeper fortnights. It is timely to point out that three JobKeeper fortnights end in August 2020, and again, in January 2021. While this will mean a higher JobKeeper payment will be received from the ATO (i.e. $4,500 instead of the usual $3,000), it may also necessitate an adjustment to those payrolls that conform to a monthly cycle, depending on whether the employer has chosen to base the monthly payroll on actual JobKeeper entitlements or an average across the JobKeeper period.

We will be publishing a detailed article which provides further explanation of this issue together with a more in-depth analysis of JobKeeper 2.0.

New decline in turnover test

Unlike the current JobKeeper rules which require businesses to satisfy the decline in turnover test only once for a single month or quarter between March and September 2020, the new rules will require businesses to continue to meet a modified decline in turnover test from September 2020 to March 2021.

Under the new rules, to be eligible for JobKeeper:

- From 28 September 2020 to 3 January 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in both the June and September 2020 quarters, relative to the corresponding quarters in 2019;

- From 4 January 2020 to 28 March 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in each of the June, September and December 2020 quarters, relative to the corresponding quarters in 2019.

In line with the existing discretion, the Commissioner will have discretion to set out alternative tests where the actual GST turnover in 2020 is not comparable with the actual GST turnover for the equivalent quarter in 2019. Businesses will be able to use their reported BAS details to determine their eligibility, and alternative arrangements will be available for entities that are not required to lodge an activity statement.

Eligibility will shift from projected GST turnover to actual GST turnover. This will require businesses to determine their eligibility earlier than the BAS lodgment deadlines to meet the wage condition. Accordingly, the Commissioner will also have a discretion to extend the time an entity has to meet the wage condition.

The design of the rules which proposes to require businesses to demonstrate that their actual GST turnover has declined by the requisite percentage in consecutive quarters does not have regard for those businesses whose situations may have improved slightly in the June 2020 quarter but have deteriorated in the September or December quarters. The Tax Institute, along with the joint professional bodies, will be seeking greater flexibility from the Government on this requirement.

What is not changing?

During the extended period of JobKeeper, it is not expected that there will be any changes to:

- The requirement for employers to satisfy the wage condition — the employer must still pay their eligible employees an amount in the fortnight that is at least equal to the JobKeeper amount;

- The specified decline in turnover that a business must suffer — 15% for ACNC-registered charities, 30% for entities with an aggregated turnover of no more than $1 billion and 50% for entities with an aggregated turnover of more than $1 billion;

- The Commissioner’s alternative decline in turnover tests;

- The special rules relating to service entity arrangements;

- The ability of ACNC-registered charities to elect to exclude government grants from their turnover;

- The meaning of ‘eligible employee’ and ‘eligible business participant’;

- The integrity rules, including the additional pre-12 March 2020 reporting requirements for businesses that qualify based on business participation;

- The enrolment process;

- The timing of the monthly payment of JobKeeper by the ATO in arrears;

- The monthly reporting of turnover to the ATO;

- Allow more than one employer to claim in respect of the same employee.

What happens next?

The announcement by the Government on 21 July 2020 needs to be reflected in legislative amendments. The current JobKeeper legislation prevents payments being made beyond 31 December 2020 so an amending bill requiring a sitting of Parliament will be necessary, and is likely to be complemented by a legislative instrument issued by the Treasurer which will set out the details of the new rules. Further details will be available once the legislative amendments are released and updated ATO guidance is published.

Government Stimulus Round 3- JobKeeper – Updated 24 April 2020

JobKeeper enrolments begin

Enrolments for April JobKeeper payments are open until the end of May with the ATO recommending enrolment by the end of April to ensure JobKeeper payments are received as early as possible.

Payments to eligible employees still need to be made on-time (that is, by end of April for April claims). Applications for claims for the month of April will open on Monday 4 May.

The ATO has released a range of guidance on the JobKeeper Payment including:

- satisfying the fall in turnover test

- steps for tax and BAS agents to help clients

- guides for sole traders and employers

- eligibility of employers

- eligibility of employees

- employee test requirements

- employee nomination notice

- eligible business participant nomination notice.

JobKeeper Explained (Source – Taxbanter.com.au)

Our Professional Partners at Tax Banter have an excellent Summary

Treasury releases a 12 Page Fact Sheet and Scenario Examples

JobKeeper wage subsidy

On 8 April 2020, a package of four Bills were introduced into Australian Federal Parliament, containing measures to implement the Government’s ‘JobKeeper payments’ wage subsidy scheme, first announced on 30 March 2020. The Bills – forming the single largest piece of government spending in Australian history – passed both Houses of Parliament without any amendments. The legislation was accompanied by exposure draft rules released by Treasury on the same day containing important detail on the measures. Note – this exposure draft law was made available for a limited time on the Treasury website before being removed. BDO will continue to monitor legislative developments so please visit this webpage for updates.

What is JobKeeper?

Employers will receive a $1,500 per fortnight ‘job keeper payment’ before tax for each employee they keep on over the next six months. It will be available to full and part time workers, sole traders and long-term casuals (a casual employed on a regular basis for longer than 12 months as at 1 March 2020). Employers can only claim $1,500 JobKeeper payment for eligible employees if they pay the $1,500 per fortnight (before tax) to each eligible employee, even if their regular wage per fortnight is less than $1,500.

What the JobKeeper wage subsidy means for your business, your employees and the economy

Designed to help maintain the connection between businesses and employees, the Government will spend around 6.5% of Australia’s annual Gross Domestic Product (GDP) on the JobKeeper scheme.1 It will support more Australians to stay in work and help limit a rise in the unemployment rate over this difficult period.

How and when will the payments be made?

Payments will be made to businesses by the ATO, monthly in arrears. The first payments will be received by businesses in the first week of May although backdated to 1 March.

The key features of the plan are outlined below:

- Wage subsidy – $1,500 per fortnight will be paid to all employers, including not-for-profits (including charities) and self-employed individuals (businesses without employees), that have been affected by COVID-19 for each worker that is employed, and backdated to 1 March 2020 (no limit on employer size).

- Employers (including non-for-profits) will be eligible for the subsidy if:

- their business has a turnover of less than $1 billion and their turnover will be reduced by more than 30 per cent relative to a comparable period a year ago (for example the Month of March 2019 compared to the Month of March 2020); or

- their business has a turnover of $1 billion or more and their turnover will be reduced by more than 50 per cent relative to a comparable period a year ago (of at least a month); and

- the business is not subject to the Major Bank Levy.

- The payment will be made to the employer, administered through the tax system, and will last for at least 6 months with the first payments expected to be made in the first week of May 2020.

Eligibility of employersEmployers (including not-for-profits) will be eligible for the subsidy if their business has ‘aggregated turnover’ in both the current and previous years is less than $1 billion and estimate their ‘GST turnover’ has fallen or will likely fall by 30 per cent or more

Eligibility of employees

Employers will only be able to claim the JobKeeper payment for eligible employees that were in their employment on 1 March 2020, and continue to be employed while they are claiming the JobKeeper payment.

An eligible employee is an employee who:

- is currently employed by the eligible employer (including those stood down or re-hired);

- is a full-time or part-time employee, or a casual employed on a regular and systematic basis for longer than 12 months as at 1 March 2020;

- was aged 16 years or older at 1 March 2020;

- was an Australian citizen, the holder of a permanent visa, or a Special Category (Subclass 444) Visa Holder at 1 March 2020;

- was a resident for Australian tax purposes on 1 March 2020; and

- is not in receipt of a JobKeeper payment from another employer.

Eligible employees include:

- employees who are retained,

- employees stood down without pay after 1 March 2020 but remain employed, and

- employees let go after 1 March 2020 and re-hired will all be eligible.

Employers that receive payments on behalf of employees that resign must notify and in some instances repay the ATO. Those that are self-employed will only receive the payments if their self-made income is in addition to that received from an employer eligible for the payments.

The JobKeeper payment is not income-tested, so employees may earn additional income without their payments being affected provided they maintain their employment (including being stood down) with their JobKeeper-eligible employer. However, they can only receive the JobKeeper payment from one employer, their primary employer.

Eligible small businesses that receive the JobKeeper payment will not be eligible for the 50 per cent wage subsidy for apprentices and trainees currently being made available as part of the Government’s COVID-19 relief from 1 April 2020 onwards.

To register your interest for the scheme, please visit the ATO website: https://www.ato.gov.au/Job-keeper-payment/

If you feel your business already meets these criteria, or are unsure if your business will meet the criteria, we encourage you to register.

Your registration will place you in the queue to receive a trading questionnaire where you can test/prove eligibility for the scheme.

Further information on the eligibility criteria for the JobKeeper Payment can be found on the attached press releases from Treasury

- For Employers – https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet_Info_for_Employers_0.pdf

- For Employees – https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet_Info_for_Employees_0.pdf

- Information Pack for Eligible employers · Eligible employees · Payment process · Timing · How to apply · Examples of the JobKeeper Payments

- https://www.business.gov.au/risk-management/emergency-management/coronavirus-information-and-support-for-business/jobkeeper-payment

- Our Professional Partners at NTAA have provided a useful summary

- https://www.lmsadvisory.com.au/wp-content/uploads/2021/02/LMS-Partner-Resource-NTAA-Proposed-Jobkeeper-payment-1.pdf

- CPA Australia Covid Resources and Homepafge for Accountants